Will the incoming RBA Governor really make a difference?

Michele Bullock will be the incoming RBA Governor as of September 18, 2023.

The current Governor of the RBA Philip Lowe has copped a bit of a hiding. The continual rising of interest rates has meant that those of us with mortgages are now paying up to 3 times the cost of what we were paying to keep a roof over our heads. It has certainly made the Governor win the title of most unpopular.

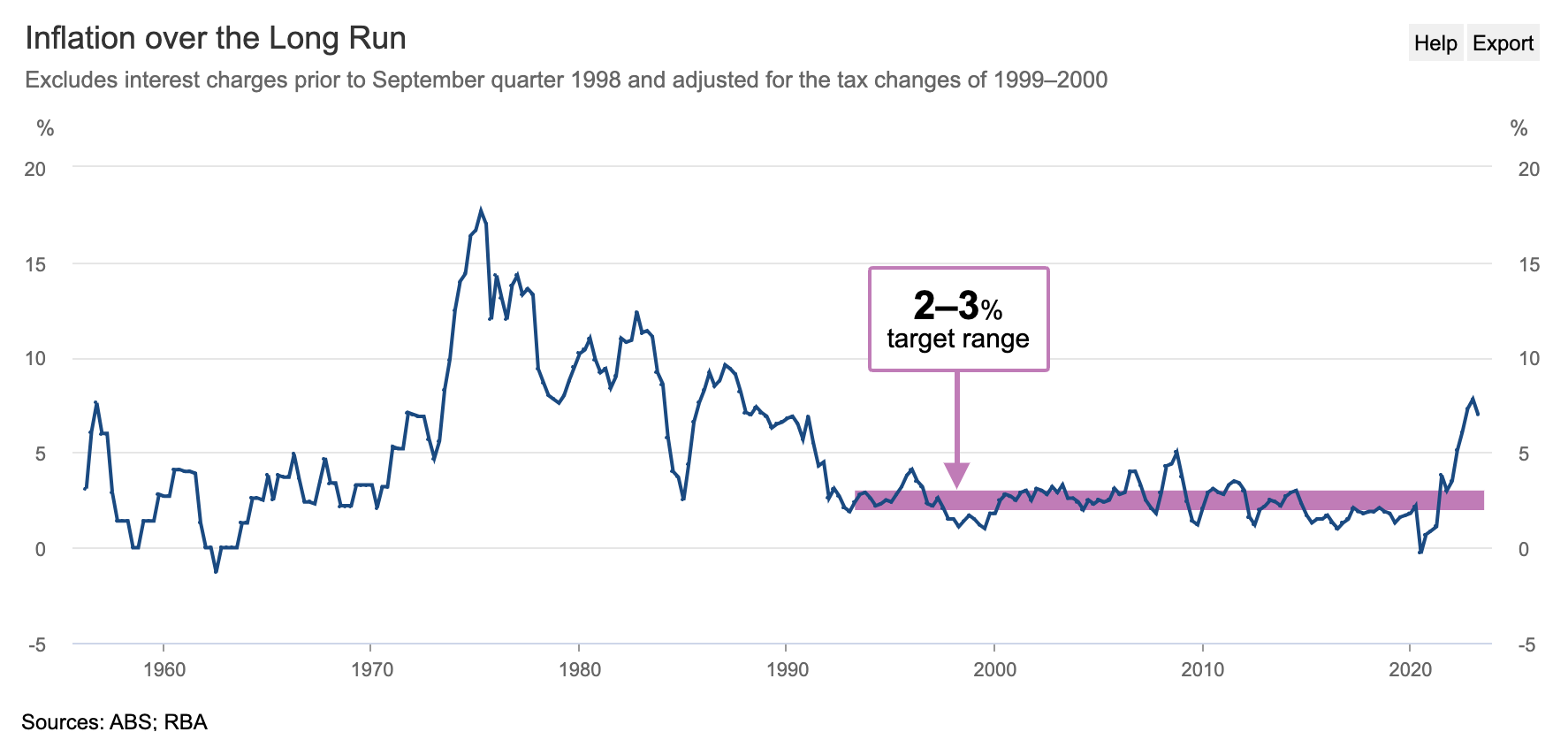

There was no denying that something needed to be done to stem the rising cost of inflation and to curb the rapidly rising property prices, and they have achieved that result, at least on property prices. However, inflation is still sitting on the high side with more work to be done to bring it from the current 7% down to the goal of 2-3%. There’s no doubt that many families are at breaking point with the current cost of living, so whoever handles inflation in the near future will have to be very mindful of how future rate rises are going to impact the 3 million mortgage holders who are already feeling the budget pinch.

Will the change of Governor make a difference? This will remain to be seen. I can’t help feeling that Lowe has fallen on his sword and will be handing over the reins to someone who can start their tenure without making the unpopular decisions to continually increase rates as I do feel that we are very near to the end of the rate rises. My prediction is that we will potentially see Lowe deliver 1 or 2 more interest rate rises before handing over to Michele Bullock in September who will then be able to paint a rosier picture, navigating us out of what could be a potential recession.

I’m not convinced that there will be any massive changes to the RBA, although there is talk of them meeting less than the current 11 times a year. Michele has been with the RBA since the completion of her undergraduate degree in the 1980’s in various capacities, most recently as the Deputy Governor. So, I’m not expecting there will be drastic changes.