Finally, are we seeing some easing in rental prices?

When out and about looking at properties I love to chat to real estate agents and get a feel for what they are seeing in the market. For many they continue to bemoan the very few listings which is affecting us all, but another interesting observation from those agents who are also across the rental market is that the market is easing, particularly in properties that are being leased out in the $1,400 or over bracket. These are properties that are nice big family homes with pools or are perhaps on the canal or near to the beach. Some of these properties have had rent reductions to attract tenants. Along with the higher end of the rental market easing, there have been fewer people attending the open homes to rent in the lower end of the market, hopefully this will make it easier for some to find their rental property.

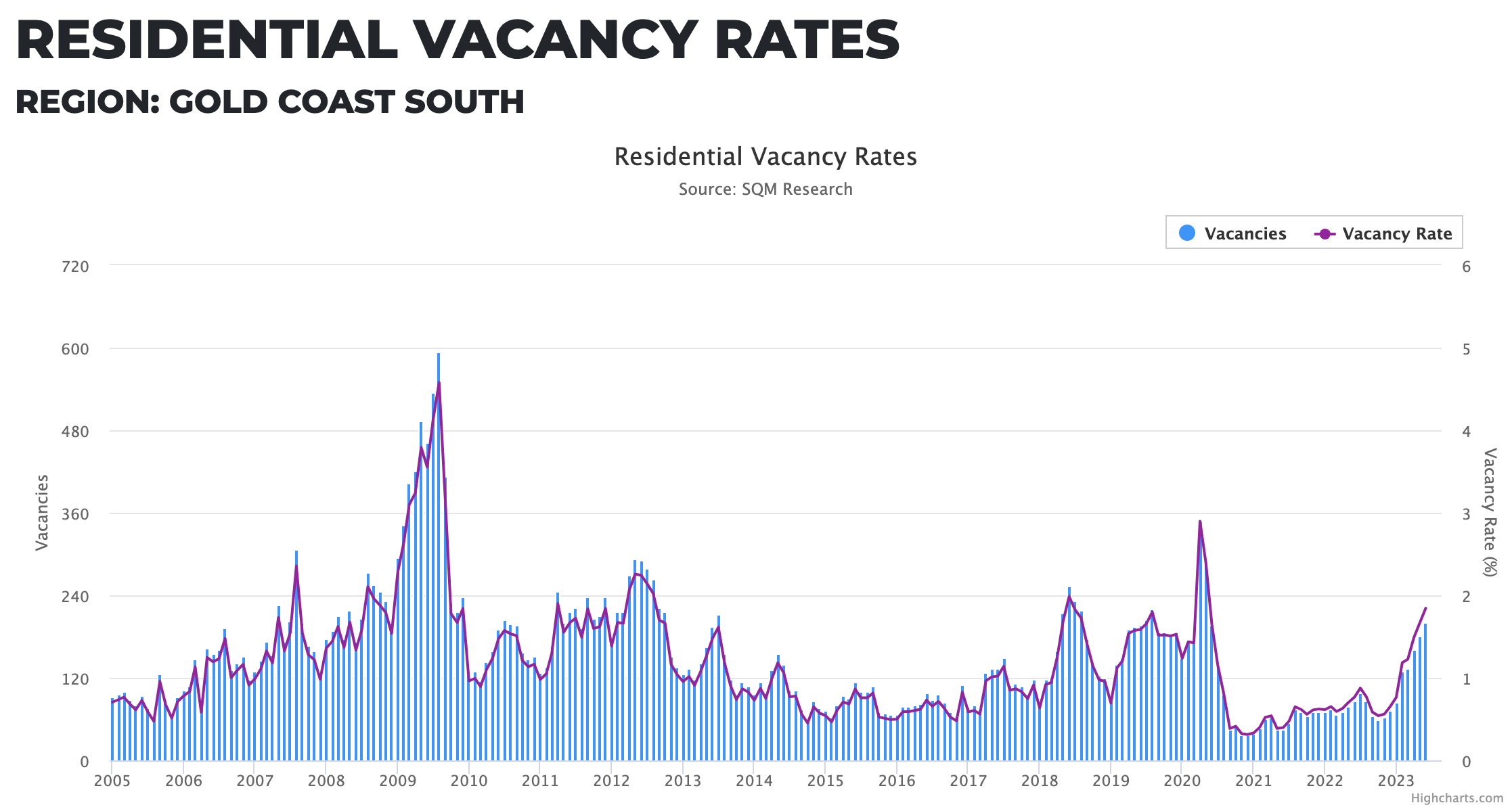

The data agrees with the agents. The Southern Gold Coast has gone from a 0.5% vacancy rate in October, 2022 to 1.8% for the month of June, 2023.

Courtesy of SQM Research

This is great news, as there’s no doubt that the vacancy rates we are currently experiencing are dire. However, I have a couple of theories which may mean that we are going to see the squeeze return in the not so distant future.

There has been a recent trend for people who have holiday let or airbnb properties to permanently let them for the winter months, normally from after the Easter school holidays to just before the Summer school holidays. This is usually the quiet season for tourism and by leasing out their fully furnished properties for those months provides landlords a consistent income during what is normally a lean period.

Once these properties come back on to the holiday let pool for the summer period and we have had more people migrate to the Sunshine State I do believe we are going to see a tightening again of these rental vacancies. So, sadly, I think this might just be a short reprieve.