Sometimes a property comes along that could very well be your dream home….

Ever dreamed of living in an RSL Prize home? For one lucky buyer they will have the opportunity this coming Sunday when Prize Draw 409 is auctioned.

John Parkes and the team at Ray White Tugun are marketing a property that is a gorgeous home right on the beach at Currumbin. In a quiet no through road, you enter the coastal charm that is 14B Darwalla Avenue, Currumbin. Set on a 530sqm block, the house was a RSL Prize home where you could purchase a ticket for just $5. The lucky winners are in their 80’s and have been purchasing tickets for over 20 years. They have no need for such a large home and instead are going to reap the rewards of supporting the RSL once the property goes to auction on the 26th November, 2023.

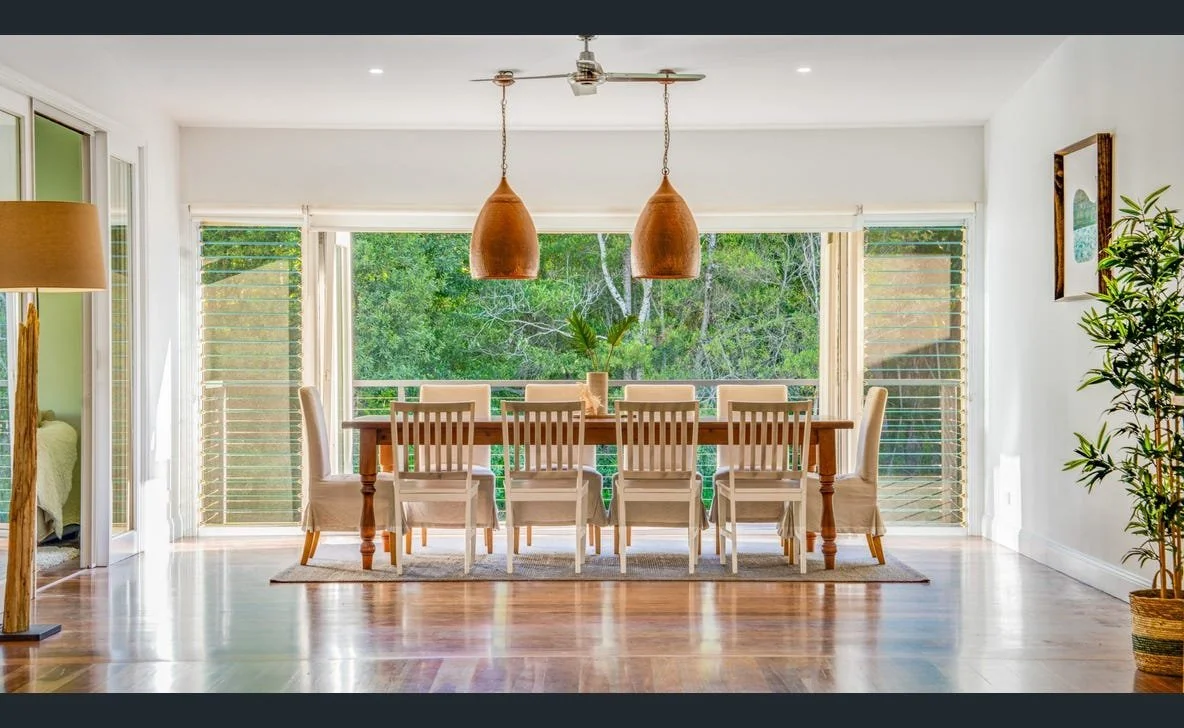

Locally designed and constructed by Designer Habitat Studio Architects, Built by Makin Constructions and styled by Kira and Kira, the property is to be sold as is, the lucky buyer will be able to move straight in.

The property exudes character and ambience with soaring ceilings and neutral tones and textures. The hero is the location with the property making use of the ocean views as the backdrop from the kitchen, lounge, pool, bedroom and upstairs entertainment space.

There is direct access to the beach through a gate which means the inviting ocean is only steps away.

The house was valued at $9.7m including outgoings, furniture and appliances, so it will be interesting to see if it will fetch close to this on auction day.

This truly is a trophy home.

What can you buy for $2m?

Here we discuss what sort of property you could purchase in Coolangatta if you had a budget of $2m.

Southern Gold Coast Realty are marketing 706/2 Creek Street, Coolangatta. This is one of the largest 2 bedroom units on the beachfront at Coolangatta. The property boasts an enclosed terraced area that adds an additional 100m2 to the floorplan and makes an ideal space to entertain guests.

But, ultimately, it’s all about the views. The views here are magnificent. The unit is elevated above the ocean to allow a great view all along the Coast from Surfers Paradise to Coolangatta. This is a great spot for dolphin and whale watching.

The property is located near to North Kirra beach, being a short stroll to the North Kirra Surf lifesaving club and a short stroll in the other direction to Kirra beach and all the cafes and restaurants that Kirra offers.

Will Victorian investors exit the property market?

With ever increasing taxes in Victoria and New South Wales, Queensland is becoming an appealing choice for investors.

South East Queensland has always seen buyers enter the market from the Southern states, particularly when the property prices start to increase in Sydney and Melbourne. There’s now more reasons for our Southern friends to contemplate purchasing property in Queensland with Victoria now boasting the highest property tax in the country.

From January, 860,000 landlords and holiday home owners in Victoria will be slugged an average of $1,300 extra in land tax and the average property tax revenue that the Victorian State Government is forecast to receive is $2,120 per person. NSW is following closely behind with $1,646 whilst Queenslanders will be set to pay $1,343.

Whilst the Queensland State Government did propose a tax which would see Queensland property owners being slugged with a proportion of Queensland land tax based on all their Australian based landholdings this was quickly quashed as a terrible idea and has since been abandoned. Not before some investors exited the Queensland market at the time.

As if the additonal tax wasn’t bad enough for Victorian investors there’s now talk of landlords in Victoria not being able to lift rents within a 2 year period. The Government are hurting most investors where it hurts the most, the hip pocket.

The intent was to ease the rental price hikes, but sadly, this is more than likely going to see a sell off of rental properties in Victoria which will ultimately hurt the renters most. Those investors will likely look to re-invest those funds in property outside of Victoria and New South Wales which will see Queensland be a great option for them.

At a time where property is in such an under supply compared to the demand, both in rental properties and properties for sale, the State Governments need to be looking at policies that support investors, builders and developers rather than hurting those they are setting out to protect.

What can you buy for $7-8m?

Here we discuss what sort of property you could purchase in the Northern NSW if you had $7-8m to spend.

Amir Prestige are marketing a property that I would love to own if I won lotto. It’s the kind of property that you could picture inviting your friends and family over to enjoy a great weekend of hanging out and having fun. It’s a sprawling private acreage property with 8 bedrooms but the real selling point for me if I had a swag of lotto money would be the short 5 minute walk to the beach.

The other thing is that there is a barn. I do love a barn. Imagine the parties you could host there? There’s also parking for 8 cars and several outdoor areas to relax and enjoy a drink with friends or to enjoy some quiet contemplation with a book once all your friends have gone home.

The property is located at South Golden Beach, just north of Brunswick Heads. A location that is still a quiet sleepy seaside town. Good news is it does have a cafe, restaurant and a fish and chip shop, pretty much everything you could need really!

Finally, are we seeing some easing in rental prices?

Is the short term easing of rental property availability a shift for the good or is it a short term lulling into a false sense of security?

When out and about looking at properties I love to chat to real estate agents and get a feel for what they are seeing in the market. For many they continue to bemoan the very few listings which is affecting us all, but another interesting observation from those agents who are also across the rental market is that the market is easing, particularly in properties that are being leased out in the $1,400 or over bracket. These are properties that are nice big family homes with pools or are perhaps on the canal or near to the beach. Some of these properties have had rent reductions to attract tenants. Along with the higher end of the rental market easing, there have been fewer people attending the open homes to rent in the lower end of the market, hopefully this will make it easier for some to find their rental property.

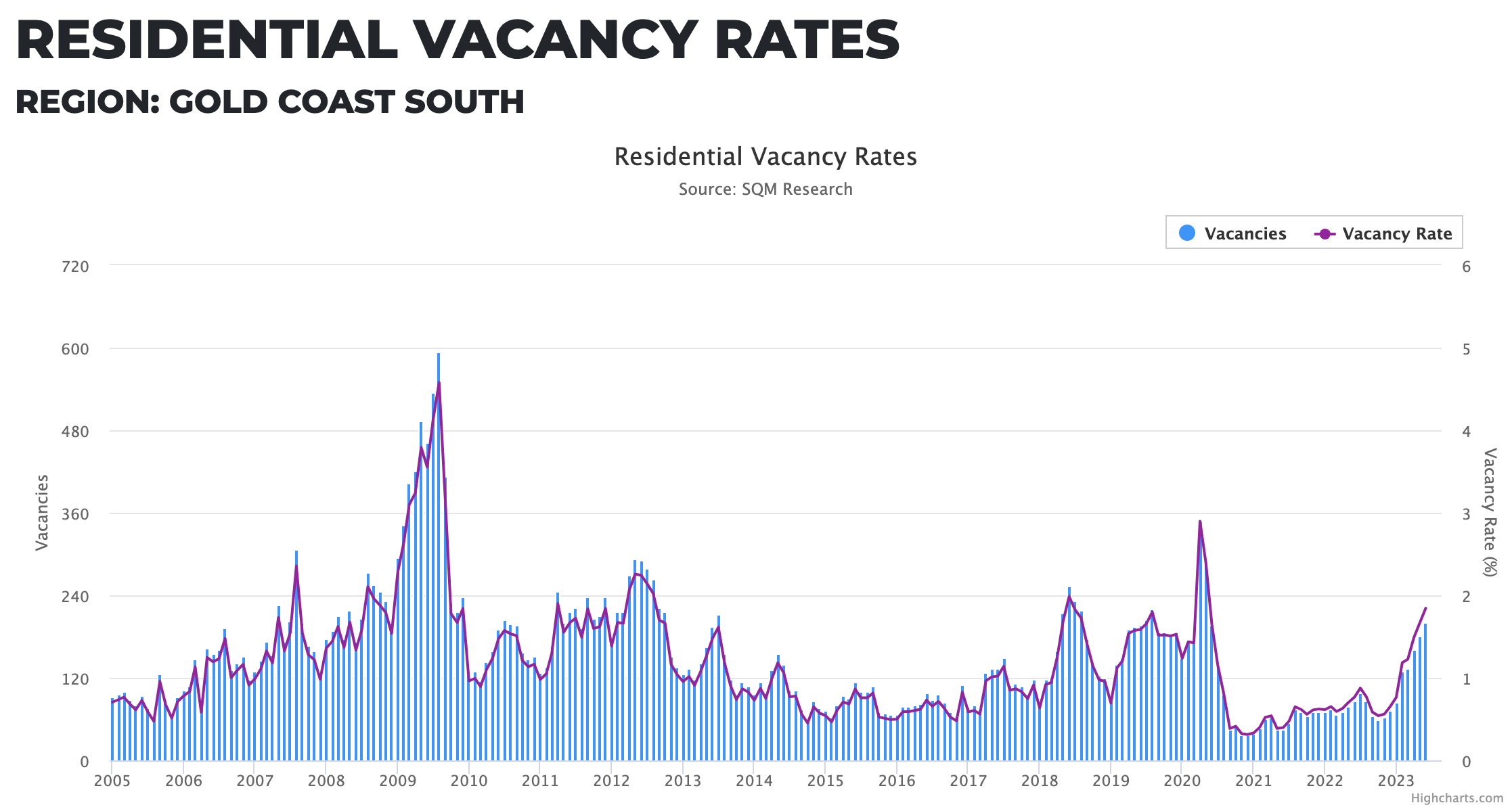

The data agrees with the agents. The Southern Gold Coast has gone from a 0.5% vacancy rate in October, 2022 to 1.8% for the month of June, 2023.

Courtesy of SQM Research

This is great news, as there’s no doubt that the vacancy rates we are currently experiencing are dire. However, I have a couple of theories which may mean that we are going to see the squeeze return in the not so distant future.

There has been a recent trend for people who have holiday let or airbnb properties to permanently let them for the winter months, normally from after the Easter school holidays to just before the Summer school holidays. This is usually the quiet season for tourism and by leasing out their fully furnished properties for those months provides landlords a consistent income during what is normally a lean period.

Once these properties come back on to the holiday let pool for the summer period and we have had more people migrate to the Sunshine State I do believe we are going to see a tightening again of these rental vacancies. So, sadly, I think this might just be a short reprieve.

Will the incoming RBA Governor really make a difference?

RBA incoming Governor, will this mean change or will we expect to see more of the same?

Michele Bullock will be the incoming RBA Governor as of September 18, 2023.

The current Governor of the RBA Philip Lowe has copped a bit of a hiding. The continual rising of interest rates has meant that those of us with mortgages are now paying up to 3 times the cost of what we were paying to keep a roof over our heads. It has certainly made the Governor win the title of most unpopular.

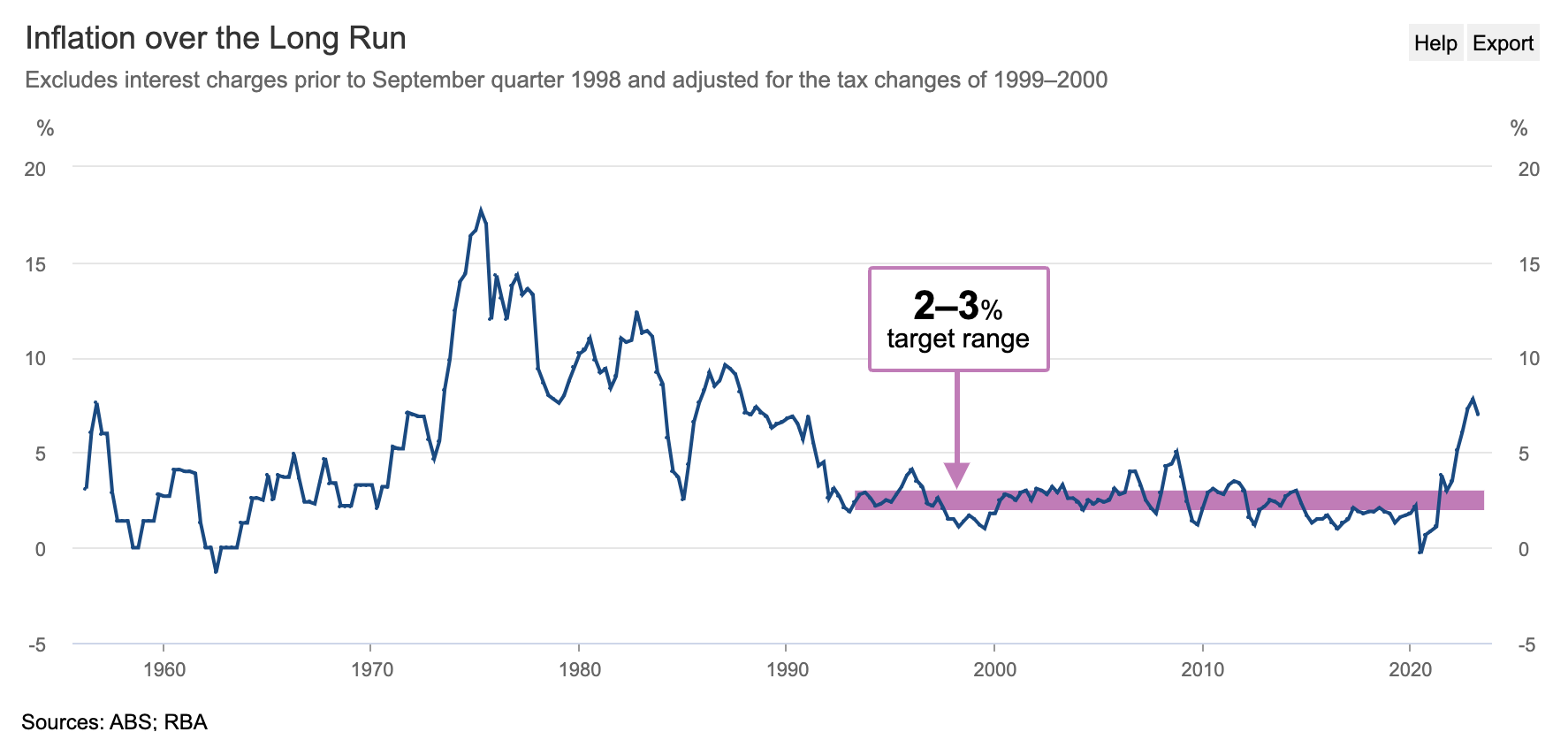

There was no denying that something needed to be done to stem the rising cost of inflation and to curb the rapidly rising property prices, and they have achieved that result, at least on property prices. However, inflation is still sitting on the high side with more work to be done to bring it from the current 7% down to the goal of 2-3%. There’s no doubt that many families are at breaking point with the current cost of living, so whoever handles inflation in the near future will have to be very mindful of how future rate rises are going to impact the 3 million mortgage holders who are already feeling the budget pinch.

Will the change of Governor make a difference? This will remain to be seen. I can’t help feeling that Lowe has fallen on his sword and will be handing over the reins to someone who can start their tenure without making the unpopular decisions to continually increase rates as I do feel that we are very near to the end of the rate rises. My prediction is that we will potentially see Lowe deliver 1 or 2 more interest rate rises before handing over to Michele Bullock in September who will then be able to paint a rosier picture, navigating us out of what could be a potential recession.

I’m not convinced that there will be any massive changes to the RBA, although there is talk of them meeting less than the current 11 times a year. Michele has been with the RBA since the completion of her undergraduate degree in the 1980’s in various capacities, most recently as the Deputy Governor. So, I’m not expecting there will be drastic changes.